Accounting Careers Trainee

Recruitment #210511-0034AR-001

| Location |

Hartford, CT

|

|---|---|

| Date Opened | 7/8/2021 12:00:00 PM |

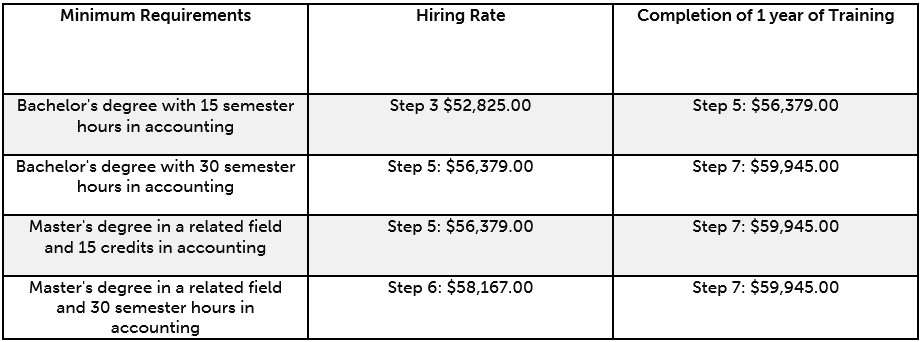

| Salary | $52,825* - $63,596/year (*Note salary information in the Introduction) |

| Job Type | Open to the Public |

| Close Date | 7/22/2021 11:59:00 PM |

Introduction

The State of Connecticut, Department of Energy and Environmental Protection (DEEP) is charged with conserving, improving and protecting the natural resources and the environment of the state of Connecticut as well as making more affordable, cleaner and more reliable energy available for the people and businesses of the state. The agency is also committed to playing a positive role in rebuilding Connecticut’s economy and creating jobs and to fostering a sustainable and prosperous economic future for the state.

DEEP's Bureau of Central Services, Financial Management Division currently has a job opportunity for three (3) Accounting Careers Trainees. The Accounting Careers Trainee is an on-the-job training program used by the agency to prepare candidates to become Accountants. This position will assist in supporting audit, business office functions, budgeting, accounts payable, payroll, grant management, compliance and review of state and federal contracting, procurement and property control. These positions are Monday - Friday, 40 hours per week, 8:00 a.m. – 4:30 pm., although variable at times in order to meet agency needs in our Hartford office at 79 Elm Street.

Note: As an Accounting Careers Trainee you will be a part of a 1 or 2 year training program depending on your level of education. The length of the training program is 2 years for individuals with a Bachelor’s degree in accounting or in a closely related business field with at least 15 semester hours in accounting. The length of the training program is 1 year for individuals with a Master’s degree in accounting or in a closely related business field with at least 15 semester hours in accounting. The length of the training program for an individual who earns a Master’s degree in accounting or in a closely related business field with at least 15 semester hours in accounting while assigned to this classification is 1 year from the date the Master’s degree is conferred or the end of the original 2 year training period, whichever comes first.

These positions come with Leading Comprehensive Benefits, Competitive salary structure, excellent health & dental coverage, generous vacation, personal, and sick time, retirement plan options & more!

Selection Plan

The immediate vacancy is listed above, however, applications to this recruitment may be used for future vacancies in this job class.

PLEASE INCLUDE A RESUME IN THE "RESUME TAB" OF THE APPLICATION.

This posting may require completion of additional referral questions (RQs) which will be sent to you via email after the closing date. The email notification will include an expiration date by which you must submit (Finish) your responses. Please regularly check your email for notifications. Please check your SPAM and/or Junk folders, as emails could end up there in error.

Please ensure that your application is complete. You will be unable to make revisions once it is submitted. Questions can be sent to Emily.Kennedy@ct.gov.

PURPOSE OF JOB CLASS (NATURE OF WORK)

In a state agency this class is accountable for mastering the skills necessary to satisfactorily complete the training program for a professional accounting or auditing position.

EXAMPLES OF DUTIES

Receives training in introductory accounting or auditing work for development of skills and knowledge in order to qualify for advancement into a professional agency accounting or auditing position; performs a variety of increasingly difficult duties as skills are acquired during the course of the training period; examines financial records of governmental or private businesses and accounting methods and procedures to ensure compliance with statutes, regulations, guidelines or accepted accounting principles; may receive training in such areas as maintaining financial records and accounts, establishing financial statements and schedules, and preparing budget estimates; performs related duties as required.

KNOWLEDGE, SKILL AND ABILITY

Knowledge of accounting and auditing principles and practices; knowledge of business mathematics and statistics; some knowledge of business uses of information technology; some knowledge of effective report writing; ability to read and understand written materials; ability to utilize computer software.

MINIMUM QUALIFICATIONS

Possession of a Bachelor's or Master's degree in accounting or in a closely related business field with at least 15 semester hours in accounting.

PREFERRED QUALIFICATIONS

-

Experience communicating, verbally and in writing, effectively across all levels of an organization

-

Experience utilizing computer software including Microsoft Office Products (Word, Excel, and PowerPoint)

-

Experience producing a variety business communications and presentations

-

Experience writing formulas and using functions in Excel

-

Experience utilizing Microsoft 365, Teams, Outlook and shared drives

-

Experience reading, interpreting and understanding written material; especially financial documents and operational documents, policies and procedures

-

Experience interpreting and applying state and federal laws, statutes and regulations

-

Experience performing arithmetical computations and analyzing financial data from accounting systems

-

Experience solving problems by exercising judgment, reasoning ability, and logic

-

Experience working in an individual or team environment and establishing and maintaining cooperative relations with superiors, associates and members of the general public

-

Experience in utilizing various ERP or General Ledger Accounting software systems

-

Strong attention to detail

Conclusion

AN AFFIRMATIVE ACTION/EQUAL OPPORTUNITY EMPLOYER

The State of Connecticut is an equal opportunity/affirmative action employer and strongly encourages the applications of women, minorities, and persons with disabilities.